Financial assistance for people in crisis

Why is financial assistance so important during a crisis?

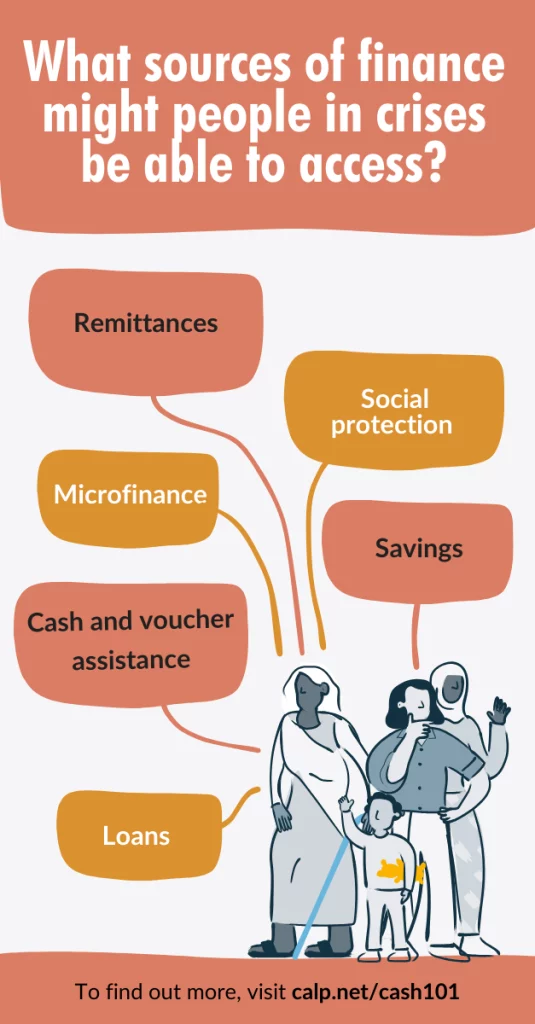

Financial assistance is a broad term that refers to any type of monetary assistance that helps support people in crisis. This might humanitarian cash and voucher assistance, remittances and financial inclusion efforts..

Financial assistance is mainly provided by governments, as well as humanitarian agencies, NGOs, private companies, or directly by individuals.

Looking at the types and flows of financial assistance in crisis is important for understanding the full context within which humanitarian cash and voucher assistance operates. Overall, humanitarian organisations play a small – but significant – part in supporting crisis-affected people to manage their own responses and build resilience against future shocks. Local community resources, remittances, government-led social assistance programmes in crisis-affected countries, partnerships with the private sector actors and digital global connectivity are part of the financial assistance landscape.

Financial assistance is changing, and this will have significant implications for the future roles of humanitarian actors, and for the ways in which they plan and deliver programmes to optimize results for people in crisis. To dive further into this topic, see CALP’s Future of Financial Assistance: An outlook to 2030 report.

Forms of financial assistance during a crisis

Social protection payments

Social protection is generally considered to be policies and programmes that help poor and vulnerable people to better deal with shocks that impact their living standards and long-term well-being. There are different forms of social protection, some which people must pay into to benefit and some which don’t. This might include (for example) unemployment benefits, disability payments or pensions for the elderly as well as free vaccination programmes or food stamps.

Social protection is normally delivered by governments. But in conflict situations or where the state is weak, non-governmental humanitarian actors might deliver this type of assistance.

Social assistance programmes have been credited with success in building resilience, and are increasingly more shock-responsive to better provide support for people in times of crisis.

To find out more, visit the Cash 101 social protection page, or CALP’s webpage on Social Protection.

Cash and Voucher Assistance

Cash and voucher assistance (CVA) provides people affected by crises with cash transfers or vouchers so they can choose and buy their own goods or services.

There are several different types of CVA, all with varying degrees of flexibility, such as conditional cash transfers, unconditional cash, multipurpose cash transfers, or vouchers. Cash and voucher assistance can be used alongside other forms of aid and in some situations, cash can be combined with other types of aid for the best results.

Remittances

A remittance refers to the transfer of money or funds from one individual or entity to another, typically across long distances or between different countries. It usually involves an individual or a migrant worker sending money to their family or relatives in their home country.

The total amount of global remittances often exceed official development aid (ODA) and are the largest source of external financial flows to in some lower and middle-income countries. In 2022, remittance flows to lower-middle-income-countries was an estimated $626 billion.

Despite being used as a safety net for many, remittances are not CVA and shouldn’t be considered a form of humanitarian aid, as they don’t necessarily go to the most vulnerable people impacted by a crisis.

Microfinance

Microfinance – also known as microcredit – is a type of financial assistance where people with low incomes are given small loans to invest in setting up or growing income-generating activities.

Microfinance schemes can be effective in both development and longer-term displacement contexts, helping people establish or expand small businesses.

One main criticism of microfinance is that if the amounts are too small they often end up being used to cover basic needs such as food and don’t go into income-generating projects. The recipient cannot then pay off the interest accrued by the micro-loan and further payments go towards paying off the interest.

These payments have to be repaid (unlike other financial flows such as cash and voucher assistance, or – in most cases – remittances).

Savings and Loans

A Savings and Loans Group is a self-managed financial assistance group of community members who meet regularly to save their money in a safe space, access small loans and obtain emergency insurance.

They are often used as a sustainable entry-level financial service for people who can’t access the typical financial systems, such as women or refugees without ID cards.

The member of the savings and loans group contribute savings into a central fund from which they can borrow as needed and repay with interest. After an agreed period, the savings and interest earned are distributed to members according to the amount each has saved in the group.

Around 90% of savings and loans groups continue to operate longer than five years after members receive training. On average a group will double their money. Such groups can be a tool to financially empower women that are unable to work, potentially increasing their independence and choices.

Cash for Work

Cash for work is a type of humanitarian cash and voucher assistance that provide cash payments to people affected by crisis on the condition that they carry out temporary work. This might be repairing roads, clearing debris, or rebuilding water and sanitation facilities.

Cash for work programmes can provide income support for people following a disaster that causes a loss of livelihoods, while also helping recovery by rebuilding public or community infrastructure.

Find out more about Cash for Work.

How significant is CVA compared to other forms of financial assistance?

Although humanitarian CVA is not the largest source of financial assistance globally to people in crises, it plays a key role in ensuring people affected by crisis are able to meet their basic needs.

While CVA is a much smaller flow of financial assistance than remittances ($6.7 billion compared to $597 billion in 2021), it plays a very important role as to targets people most affected by crises.

Although remittances are used as a safety net by many, they are sent at the senders’ discretion and might not reach the most vulnerable, such as women or the elderly. In humanitarian contexts, remittances tend to be given during sudden-onset crises, such as a flood, but not as much during protracted crises, such as drought or conflict.

Government social assistance provides support for 2.5 billion people globally and is an important part of responding to crises. However, in many fragile states and disaster-prone countries, capacities for social transfers are still limited: in 2018, only 18% of the poorest people in low-income countries were covered by social transfers.

How does Cash and Voucher Assistance link to other forms of financial assistance?

Cash and voucher assistance is just one of several forms of financial flows people can access during or following a crisis. Linking CVA with other forms of financial assistance can often provide a more effective way to support the needs of people affected by crises.

For example, combining CVA with other forms of financial assistance can provide short-term emergency relief while building longer-term resilience. A pilot of CARE’s Village Savings and Loan Associations in Emergencies model for women impacted by the conflict in Yemen found that combining cash transfers with savings and loans groups allowed people to develop a significant safety cushion to help address future shocks.

When suitable, linking humanitarian CVA to social protection can bring many benefits, including better coverage and adequacy of social protection programmes. Building stronger social protection systems could eventually provide more effective assistance to people in crises, help to make people more resilient to shocks, and reduce the need for humanitarian assistance.

Humanitarians can also make use of existing platforms and processes of social transfer programmes to deliver humanitarian cash-based responses. This could potentially speed up response times and allow agencies to reach larger numbers of people, more quickly.

For more information on CVA, visit other pages on the Cash 101.