Digital Payments

Digital technology is transforming the way we respond to emergencies. Innovations range from how we identifying people eligible for assistance, to data collection for assessments and monitoring, to communication with crisis-affected communities. Digital payment systems, including mobile devices, electronic vouchers, and cards – when used appropriately – can deliver timelier, more secure, more cost effective, and inclusive assistance. But as the volume of data we collect, store and share about people grows, we must ensure that our data protection systems keep pace and that we understand and mitigate for the risks inherent in new technologies.

Featured Content

Podcast: Is informed consent possible in humanitarian CVA?

Podcast

Episode 2 of the CashCast tackles data responsibility with Amos Doornbos, Linda Raftree, James Eaton Lee and Ric Tighe

Consent and Ownership in the Shift to Digital Cash and Voucher Assistance

Blog Post

Part of committing to cash and voucher assistance (CVA) is committing to going digital and collecting data. While they are two different things, they are deeply intertwined. And while an organisation can ‘go digital’ without cash programmes, it’s nearly impossible to commit to cash programmes in the long term without going digital. Yes, it is true we’ve done cash and voucher programmes...

Latest

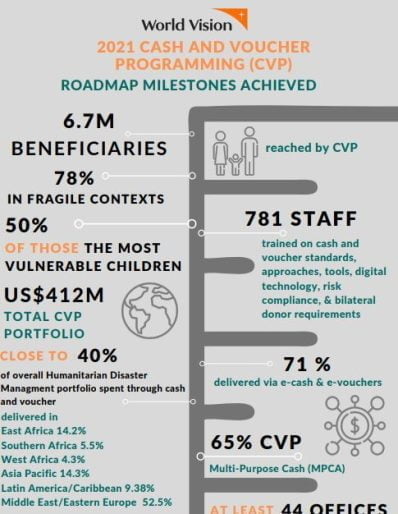

2021 Cash And Voucher Programming (CVP) Roadmap Milestones Achieved

Report

Summary Report of World Vision’s global progress report and milestones (against WV’s global Cash Roadmap Strategy) in Cash Voucher Assistance (Cash Voucher Programming-CVP) facilitated by World Vision in over 44 countries, reaching more than 6.7 Mio vulnerable people (78 % in Fragile Contexts) in...

The Receipt

Report

Save the Children Australia: Pacific Cash Preparedness and Response Program Newsletter

Next Level Integration with Financial Service Providers in Kenya and The Netherlands

Report

When collaborating with Financial Service Providers (FSP) it might be challenging to oversee the process, especially when having to scale up. By using software-based integrations, often with the use of Application Programming Interfaces (APIs), NGOs can now provide Cash-Based Aid more efficiently and at...

Improving Cash-Based Interventions (CBIs) and the RFP Process

Report

Over the last two decades, governments as well as humanitarian and relief organizations have dramatically expanded the use of cash and cash equivalent transfers to combat poverty, improve health outcomes and expand access to basic goods and services. Both academic research and on-the-ground experience...

Making humanitarian cash programming easier, safer and faster through the 121 Platform

Presentation

Better Cash Information Management and improved systems and tools can address the gap for humanitarian organisations and increase cash program quality and scale. The 121 Platform offers this solution with a Humanitarian Organisation Portal, Aid Worker App and Person Affected App. With the 121 Platform, we...

Financial Literacy Training In Uganda’s Refugee Response – A Learning Brief

Report

The Financial Literacy Training (FLT) Learning Brief draws together experiences and lessons learned from the U-Learn Financial Literacy Training analysis, the FLT discussion paper and a learning event. It provides an overview of FLT practices and experiences in Uganda, and includes recommendations that...

Pathways from CVA to long term financial inclusion: A framework for success

Blog Post

CVA programs can provide a springboard to financial inclusion. But spotting the right opportunity, and good programme design, are key. GSMA and Mercy Corps share a simple tool to understand which contexts offer the best pathways from CVA to financial inclusion.

Assessment of Financial Service Providers – Cash and Voucher Assistance in Uganda

Case Study

Under the Uganda Refugee Response Plan (RRP) 2018-2022, both international partners and local government place a strong emphasis on shifting the response paradigm “from care and maintenance to inclusion and self-reliance.” In pursuit of this objective, cash-based interventions are marked as a modality...

How do great ideas scale? Learning from successes in humanitarian innovation

Report

Scaling innovations in the humanitarian sector is notoriously difficult, and existing research highlights the many barriers and challenges to scaling humanitarian innovations. This study sought to fill an important gap in the literature by identifying and outlining key lessons from humanitarian...

Slides for the Global CWG meeting – Oct 2021

Presentation

The enclosed slides for the 28 October meeting feature presentations from WFP, the Uganda and CAR CWGs and GSMA , as well as key links to key resources discussed.

Digital identity, biometrics and inclusion in humanitarian responses to refugee crises

Report

Digital identity and biometrics have long been divisive topics in the humanitarian sector. On the one hand, they have the potential to be more inclusive and reach people in need at scale due to perceived efficiency gains. A legal identity for everyone as part of the Sustainable Development Goals (SDGs)...

The Receipt

Report

Save the Children Australia: Pacific Cash Preparedness and Response Program

Confidence and usage of ATMs

Report

For the reports click here The World Food Programme (WFP) supports Syrian refugee families living in extreme poverty in Lebanon by providing them with multi-purpose cash (MPC) transfers to meet their basic needs. WFP loads the assistance on an e-card, called the Red Card, each month and programme...

Minding the (financial and digital) gap! – How informal social safety nets leverage digital & cash enablers in COVID-19 pandemic

Presentation

Minding the (financial and digital) gap! – How informal social safety nets leverage digital & cash enablers in COVID-19 pandemic: In every context, strengthening the links between cash transfers, savings groups and digitisation contributes to resilient recovery from COVID-19. Representatives of...

Cashing in: Turning Challenges into Opportunities when Evaluating Humanitarian Cash Assistance

Report

The use of cash transfers in humanitarian action has implications for evaluative activity. On the one hand, the utility of some evaluations has been strengthened by the increased attention that has been paid to evaluating cash transfers, the agreement of common outcome indicators and the creation of...

“Doing no harm” in the digital age: What the digitalization of cash means for humanitarian action

Policy paper

Cash transfers have changed the way the humanitarian sector delivers assistance, and at the same time, digitalization is changing the way our world works in fundamental ways. The digitalization of cash means that the simple click of a button can put money in the hands of hundreds of thousands, if not...

Towards shock-responsive social protection: lessons from the COVID-19 response in Pakistan

Report

The stringent lockdown measures and global economic slowdown, due to COVID-19, are likely to increase the poverty rate in Pakistan by 35 percentage points in urban areas and 32 percentage points in rural areas. The report documents the Government of Pakistan’s social protection response to mitigate the...

2020 Cash and Voucher Programming (CVP): Roadmap and milestone achieved

Report

In 2020, World Vision has implemented cash and voucher programming like never before – not least due to the COVID-19 pandemic and related social protection transfer scale-ups. From 2019 to 2020, we have seen a 28 % increase of our cash, voucher based programming, moving towards enabling affected...

CASH ON THE MOVE – Adapting Multi-Purpose Cash ‘Plus’ Assistance to support people on the move in Peru

Report

In 2019 and 2020, with the support of USAID´s Bureau for Humanitarian Assistance (formerly FFP and OFDA), Save the Children implemented

a multi-purpose cash ‘Plus’ program in response to the influx of Venezuelan migrants into Peru.

Households that were only transiting through the cities where they...

Digital Currency Governance Consortium White Paper Series

Report

The Digital Currency Governance Consortium (DCGC) convenes more than 85 organizations from the public sector, private sector, civil society and academia to provide a global perspective towards addressing high priority policy and governance issues surrounding new forms of digital currency. DCGC has focused...