Pathways from CVA to long term financial inclusion: A framework for success

Impact Opportunity

In 2016, under our PRIME program in Ethiopia , Mercy Corps established more than 2,000 mobile money accounts for participants of a cash distribution, with guidance to maintain a small minimum savings balance. The rationale? With this support participants could start saving further, send money to family members, or carry out other transactions. In short, they would be ‘financially included.’ The only problem? Nearly 90% of participants withdrew more than 90% of their money (falling below the minimum balance) after the final distribution, and only 2% of customers ever deposited additional funds into their account.

So the question remains: When, and how, can cash and voucher assistance (CVA) programs lead to greater financial inclusion?

Mercy Corps and GSMA’s Mobile for Humanitarian Innovation programme believe that CVA programs can provide a springboard to financial inclusion. They can help create a more sustainable impact on income growth or asset accumulation, and resilience building. We’re calling it Cash-2-Financial Inclusion (C2FI). But what does it take to make this happen?

Cash and voucher assistance (CVA) programs meet a wide range of humanitarian needs, from emergency responses to supporting protracted crises. But there are limitations to their long-term impact on economic well-being, income, and resilience. Mercy Corps’ own research from Iraq recently demonstrated that even just delivering financial health and literacy training alongside cash programs can strengthen the effect of economic and social outcomes.

The explosion of mobile money has increased the opportunities for Cash2FI outcomes. Bank and mobile money accounts offer recipients access to an ‘open-loop’ system to manage any number of transactions. Having a mobile money account is about more than just a way of receiving cash payments and a place to store funds, it also gives the user access to every-day financial services, like paying children’s school fees; paying for energy needs; receiving remittances from abroad; accessing savings, loans and more. .

Despite these promising trends, it is far from a done deal. There are a complex set of constraints within the enabling environment, and considerations regarding the target population, that dictate the design and likelihood of success for C2FI programming.

The C2FI Matrix

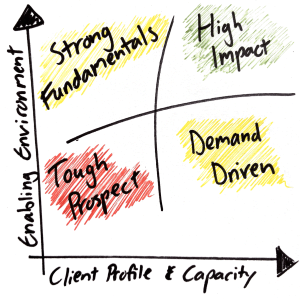

The C2FI matrix provides a simple tool to map and understand the financial inclusion potential of CVA programs. On the ‘Y’ axis we capture how challenging or supportive the overall enabling environment is, while the ‘X’ axis assesses the profile and capacity of the target clients. Practitioners can use this matrix to understand the viability of linking CVA to financial inclusion outcomes, and the prerequisites of a functioning digital ecosystem and suitable target population.

To assess the enabling environment, the matrix considers regulation, the supply of financial services, and the digital ecosystem. It is important to understand Know Your Customer (KYC) requirements for financial service providers, and whether they are realistic for the target clients. A sufficient supply of relevant, or adaptable, financial products, provided through trusted institutions in the target geography is another prerequisite; and of course, mobile network coverage and access to a reliable agent network are critical conditions for digital cash transfers.

To understand whether C2FI is an appropriate goal for the target population, the matrix considers their ability to meet basic needs, their ability and eligibility to access financial services, and relevant knowledge and understanding. Households must have the financial capacity to meet their most immediate consumption needs and have money left over for savings or other investments; they also need the cognitive bandwidth required to invest in their longer term future. Ownership of required ID documents, and the mobility and freedom to use financial services or pursue income generating activities are other key recommendations. By quickly assessing these factors, we can map a C2FI opportunity into one of four quadrants on the matrix.

High Impact: Both a strong enabling environment and a suitable target population create a good opportunity to deliver C2FI. This might occur in protracted crises in relatively stable contexts and mature markets, for example refugees in Uganda.

Strong Fundamentals: A sufficiently mature financial services market and good operating environment might allow for C2FI programs; but deeper analysis and design is required to ensure financial services can understand and respond to the needs of customers.

Demand Driven: Despite a challenging operating environment, there is clear client capacity and demand to springboard to financial inclusion. One example could be Iraq, where there is deep mistrust in institutions that must be overcome to successfully deliver C2FI.

Tough Prospect: Where both the enabling environment and client capacity or demand are weak, C2FI programs are unlikely to succeed. Informal models, for example, that might link CVA participants to savings groups, might be an option in these scenarios.

Building an Evidence Base

Moving from CVA to financial inclusion will require a concerted effort by stakeholders, working together to overcome existing barriers, particularly regulatory hurdles, limited networks and digital payments infrastructure, and low levels of digital and financial literacy. And we need evidence! Through this initiative, we are trying to better understand the pathways from CVA to financial inclusion, and will use the C2FI matrix and pilot test programs in the months ahead. While we do need to recognize that C2FI will not always be a suitable or viable option, the matrix can offer a valuable framework to analyze and identify the most compelling opportunities, and further test and develop this approach.

Mercy Corps and GSMA will be sharing two papers in the coming weeks to dig deeper into the framework described above, as well as a deeper set of guidance on designing programs for C2FI. At the very least, we hope this can kick start an important dialogue between donors, MNOs, CVA practitioners and the financial inclusion community to test, develop and build out the evidence base.

Main image – Farah brings her goats home at the end of the day. She received cash as part of MercyCorp’s PRIME program in Ethiopia, and was also member of a petty trade and livestock co-op in Gode within the Somali region. Credit: Kelly Lynch/Mercy Corps. April 2014.

Authors:

Mike Warmington, Director – Financial Inclusion, Mercy Corps

Mike joined Mercy Corps as director of financial inclusion in 2019, leading agency strategy and providing support on design and implementation of FI programs across Mercy Corps’ global programs. Prior to Mercy Corps, Mike was partnerships director at One Acre Fund, leading innovative partnerships in the cocoa sector as well as with microfinance institutions across East Africa. He previously held roles as head of operations at a tier 2 MFI in Malawi and Zambia, and in structured finance for Dexia bank’s UK project finance team. Mike has a BA in economics and an MSc in international development.

Jenny Casswell, former Director of Research and Insights, Mobile for Humanitarian Innovation, GSMA

Jenny Casswell, former Director of Research and Insights, Mobile for Humanitarian Innovation, GSMA

Jenny has been leading research programmes on digital innovation in development and humanitarian contexts for over ten years, most recently as Director of Research and Insights for the GSMA Mobile for Humanitarian Innovation programme. Previously, Jenny worked as a researcher in the GSMA Disaster Response and M4D Utilities programmes. Prior to joining GSMA, Jenny worked for a public affairs consultancy, leading programmes and campaigns for UN agencies and INGOs. Jenny holds a BA in Geography from Oxford University and is currently undertaking a Global MBA at Warwick Business School.