Is mobile money preferred by cash recipients in refugee response?

The message from cash recipients in Uganda is clear – they have a strong preference for receiving cash via mobile money. These are the findings from a study by U-Learn and the Uganda Inter-Agency Cash Working Group (CWG) conducted last year spanning 13 refugee settlements and 12 refugee-hosting districts across the south-west and West Nile regions.

Experience shows that aid interventions are more empowering and successful when participants’ experiences, perceptions, and preferences guide programme design and delivery. In Uganda, 97% of refugees receive some form of cash-based transfers as direct cash transfers, mobile money and through bank agents.

Humanitarian actors are now increasingly looking towards digital financial aid to deliver assistance. But what do recipients think? Read on to learn more about recent research findings on user preferences and perceptions of inclusion associated with different modalities of aid distribution.

Mobile money is the preferred delivery mechanism

In refugees and host communities across the 13 settlements in Uganda, the most sought-after financial tool is mobile money, or digital financial services that allow people to receive, store and spend money using their mobile phones.

Mobile money can work in areas with mobile network coverage only; access to the internet is not necessary. The research shows that mobile money tops even direct and over-the-counter (OTC) cash for its convenience, privacy, and ease of use in both humanitarian and commercial (non-aid related) settings.

Unlike bank accounts, which “people would not open if it wasn’t for receiving assistance”, according to a female refugee in the south-west region, “mobile money is popular whether they are receiving financial assistance or not,” said a male host community member in the West Nile region.

Experiences in East Africa show that the use of mobile money has skyrocketed since the onset of the pandemic as a result of physical distancing measures, and the U-Learn research reveals that 64% of refugees and 75% of host communities currently use mobile money.

What affects the popularity of other mechanisms

The data shows that nearly two-thirds of both refugees and host community members (64% and 67% respectively) have low levels of education and self-report that they are not literate. Illiteracy contributes to people’s preferences for aid delivery mechanisms without complex registration processes; leaving bank transfers in the dust when compared to the relatively speedy process of SIM-card registration and mobile phone subscriptions.

Bank transfers and smart cards

Even though bank transfers and smart cards are perceived to be the most secure, less than half of people without bank accounts are interested in having an account — owing to complex registration processes, geographical distance to banks and the high costs associated with opening and maintaining an account.

Prepaid or smart cards, which are loaded with allowances by humanitarian organizations, suffer the same caveats, with the additional pressure of cashing out with an agent within a set time-frame. In addition, literacy barriers prevent more than 70% of women refugees from opening or using a bank account.

“These cards have expiry times and dates and even if the card is just five minutes late, you can’t use it, hence making losses”, said a female host community member in the West Nile region.

Direct cash

Though direct or over the counter (OTC) cash provides financial assistance without the need for any kind of literacy, people often have to wait long hours in harsh weather conditions to collect funds at public, and thus less secure, distribution sites.

“Mobile money is also confidential compared to when someone is given direct cash, for example if someone is given 1 million UGX, [USD 283.73] directly when all the others are seeing, they may even follow him or her and they steal the money,” said a host community leader in the West Nile region.

The social distancing requirements and hygiene measures required to prevent the spread of the COVID-19 pandemic make in-person collections even riskier.

“Direct cash is not good because there is always overcrowding during the distribution and if there is also COVID, they may contract the disease,” said a male refugee in the West Nile region.

While mobile money is the most preferred, the picture is not that clear cut. It’s important to note that people are inclined to favour what they know. For instance, in the south-west region where prepaid or smart cards are frequently used for financial aid delivery, that model is gaining favour while the waning use of direct or OTC cash to transfer aid has led to the mechanism’s dwindling popularity among refugees.

Is the future digital?

Could the need for greater cost efficiency and streamlined financial aid delivery function as a catalyst to move the needle on digital financial assistance mechanisms — and encourage users to increasingly make digital transactions?

Probably; a similar evolution took place about 15 years ago when the sector started to transition from in-kind aid to cash and voucher assistance.

According to the latest United Nations High Commissioner for Refugees (UNHCR) Refugee Response Plan (RRP) funding dashboard — humanitarian actors in Uganda are now looking towards digital financial aid to deliver assistance.

The funding shortfall is unlikely to rebound and the logistical efficiency of digital financial aid delivery, coupled with the regional popularity of mobile money, provides further impetus for the adoption of digital mechanisms for aid delivery.

Adopting mobile money – training is key

Yet special care needs to be taken to ensure that the new modalities are accompanied, or preceded by, measures to support access to and use of tools. The research conducted by U-Learn shows that if available digital financial tools can be supported by basic and digital literacy training, it will strengthen the inclusiveness of digital aid delivery.

The link between experience and preference, coupled with people’s strong overall preference for mobile money regardless of familiarity, signals a positive outlook for financial aid providers looking to adopt mobile money as a delivery tool.

“More people would use digital financial services if trained because they will have gained knowledge of using [them] and would have less or even no doubts about being cheated,” noted a female refugee in the south-west region.

But training is not the only change that needs to happen if digital is to stay, there is the question of moving to interoperability of payment platforms, resolving the shortfall of mobile money (and banking) agents serving refugees, increasing the network coverage in some regions, and the creation of infrastructure that will enable humanitarian actors to link refugee households to the cash transfer modalities of their own choice.

Because ultimately that is the goal, for refugees to be able to receive cash through the modality and provider of their own choice.

Find out more

Take a look at the full report by U-Learn and the CWG to learn more about beneficiary preferences regarding financial service in the refugee response.

Additionally, you can look at the summarized findings, or watch the

report’s author summarizing the main findings in these videos.

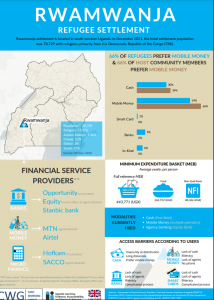

There are also settlement-level CVA infographics the variety of information sources. They provide a snapshot settlement by settlement.

Does your experience align with the findings of this report? We’d love to know. Drop a comment below.

Main Image: © Geoffrey* (not real name), a mobile money agent in Rwamwanja settlement in Uganda at work in his kiosk. U-Learn 2021

About the author

Kullein Ankunda is the communications manager for U-Learn. She has experience in Communication for Development and Behavior Change Communications. Since joining U-Learn, she advocates, and facilitates the use of evidence to inform refugee response programming. She lives and works in Uganda.